How to Identify and Avoid P2P Crypto Scams

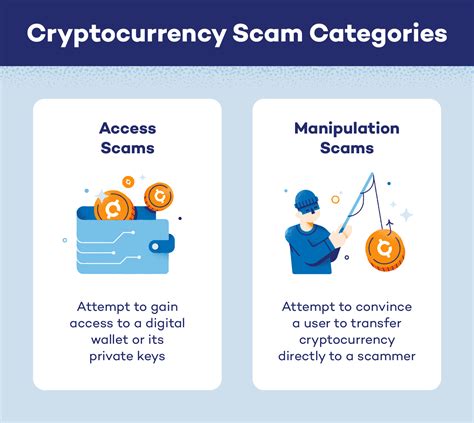

The rise of peer-to-peer (P2P) cryptocurrency exchanges has made it easier for individuals to buy, sell, and trade cryptocurrencies. However, the market is not without its risks, particularly for those new to cryptocurrency trading or inexperienced investors. One type of scam that has gained popularity in recent years is the P2P crypto scam.

A P2P crypto scam occurs when an individual is tricked into investing their funds with a fake online exchange, Ponzi scheme, or other unscrupulous organization. These scams can be devastating for those who fall victim to them, resulting in significant financial losses and even personal identity theft. In this article, we will explore how to identify and avoid P2P crypto scams.

Red Flags: Warning Signs of a P2P Crypto Scam

To avoid falling victim to a P2P crypto scam, it is essential to be aware of the following warning signs:

- Unsolicited Contact: If someone contacts you out of the blue with an investment opportunity or asks for money, be cautious. Legitimate online exchanges and cryptocurrency services typically do not initiate contact with potential investors.

- Too Good to Be True Offers: Any investment offer that seems too good to be true should raise red flags. Scammers often promise unusually high returns on investments with little risk.

- Lack of Transparency

: If the person or organization behind an investment is secretive about their methods, fees, or financials, it may be a sign of a scam.

- Unregistered Exchanges: Verify that any online exchange or cryptocurrency service you are considering is registered and reputable.

How to Protect Yourself

To protect yourself from falling victim to a P2P crypto scam:

- Research, Research, Research: Conduct thorough research on the investment opportunity before investing any funds. Look for reviews, testimonials, and information about the company’s reputation.

- Verify Credentials: Check if the person or organization behind an investment is registered with reputable regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

- Be Cautious of Unsolicited Offers: Be wary of unsolicited contact from anyone who approaches you with an investment opportunity.

- Use Secure Payment Methods: Only use secure payment methods, such as reputable online exchanges or cryptocurrency wallets that offer two-factor authentication and robust security measures.

What to Do If You’ve Been Scammed

If you have fallen victim to a P2P crypto scam:

- Report the Incident: File a complaint with the relevant regulatory bodies, such as the SEC or CFTC.

- Contact Your Bank or Exchange: Inform your bank and online exchange about any suspicious activity or potential scams.

- Monitor Your Accounts

: Keep an eye on your accounts for any unauthorized transactions or changes in your investment portfolio.

Conclusion

P2P crypto scams can have devastating consequences for those who fall victim to them. By being aware of the warning signs, researching investment opportunities thoroughly, and verifying credentials, you can reduce your risk of falling prey to these scams. Remember to stay vigilant, monitor your accounts regularly, and seek help if you suspect a scam.

Additional Tips

- Educate Yourself: Stay up-to-date with the latest news and trends in cryptocurrency trading.

- Use Secure Cryptocurrency Wallets: Use reputable cryptocurrency wallets that offer robust security measures and two-factor authentication.

- Avoid Investment Opportunities That Promise Unusually High Returns: Legitimate online exchanges typically do not offer unusually high returns on investments with little risk.

By following these tips, you can significantly reduce your risk of falling victim to a P2P crypto scam.